What’s Happening at SFG? see all news see all events

SFG: An active community building the financial system of the future

Sustainable Finance Geneva (SFG) is a pioneer association dedicated to promoting sustainable finance in the Swiss market. Established in 2008 in Geneva, Switzerland, we are a grassroots network of 400+ professionals and 50+ institutions committed to building the financial system of the future – one that serves the needs of people and respects the planet.

"As awareness of our dependence on natural systems grows, so does our capacity to find solutions. I am convinced we will transition towards a financial system that is regenerative by design."

— Marie-Laure Schaufelberger

Geneva: A unique ecosystem poised to make global change

Geneva is uniquely positioned to address the urgent challenges crystallized in the UN’s Sustainable Development Goals (SDGs), thanks to its one-of-a-kind ecosystem: a global financial centre, combined with a hub for multilateral diplomacy, world-class academic institutions and forward-looking policy-makers.

This unique diversity of actors makes for an exceptionally rich ecosystem, committed to making sustainable finance a central pillar of growth in business, wealth management and institutional asset management.

What We Do

We serve our members and the Geneva community in implementing sustainable practices in the finance industry. Our strategy is comprised of three main pillars:

Strengthen Connections

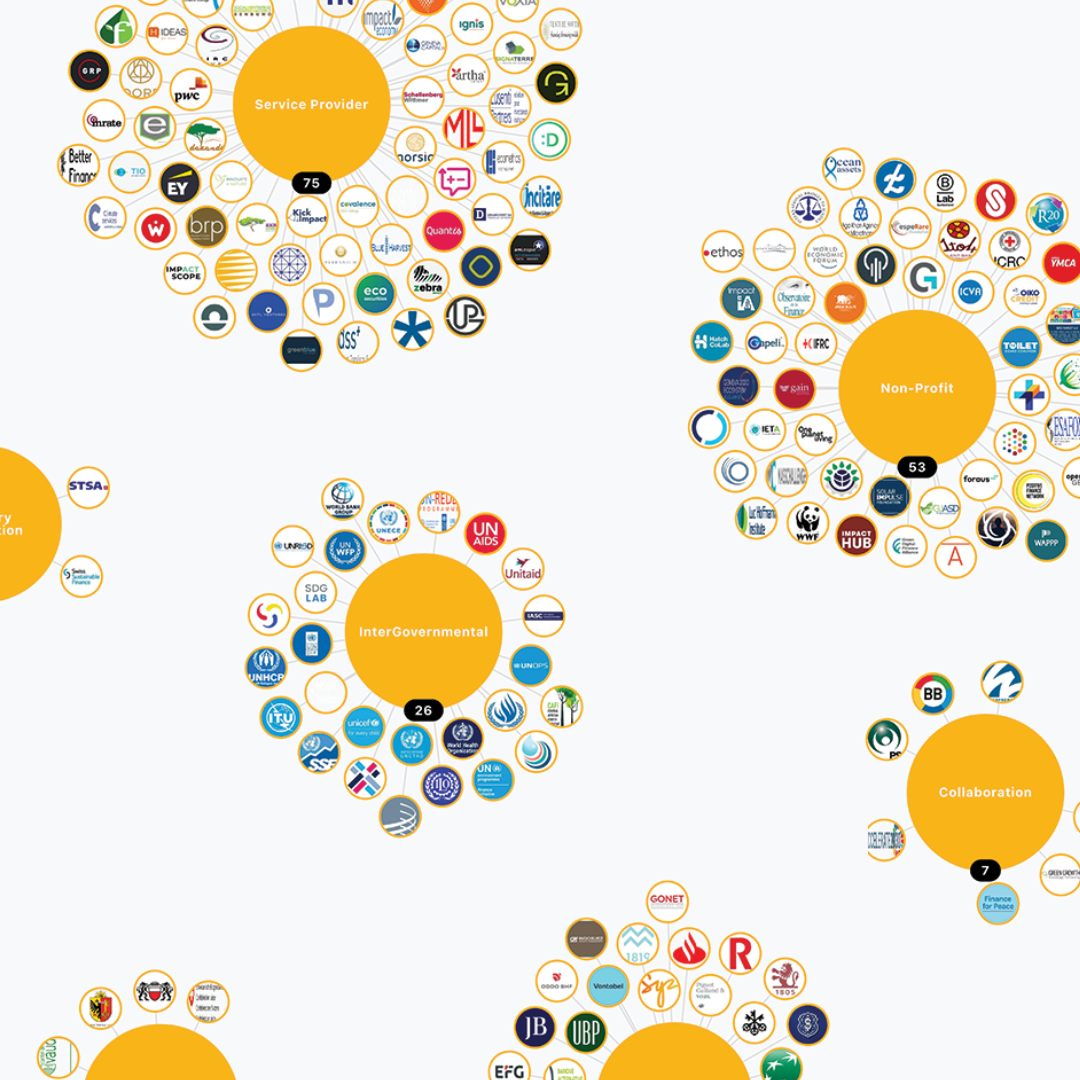

Through our events, we create meaningful moments for diverse actors to connect and exchange. In addition, we provide tools like our Ecosystem Map that support individuals and institutions in navigating the ecosystem and building their own networks.

Empower Individuals

We arm individuals with knowledge by providing them with hands-on learning opportunities. We also provide a platform for dialogue and discussion, welcoming diverse views and ideas on sustainable finance solutions.

Mainstream Impact

We put new impact themes “on the map” by providing curated and actionable knowledge for investors and financial players. We also bring key players with different perspectives together to co-create actions for advancing impact.