The world’s leading liquid and regulated impact investing market

SWISOX mission and vision

Sustainable Finance Geneva, SFG, with the help of the Swiss National Science Foundation and a few private foundations is incubating the creation of the 1st regulated liquid social stock exchange (SWISOX) with the ambition to respond to the inefficiency of the impact investing market and to respond to the demand for a liquid marketplace.

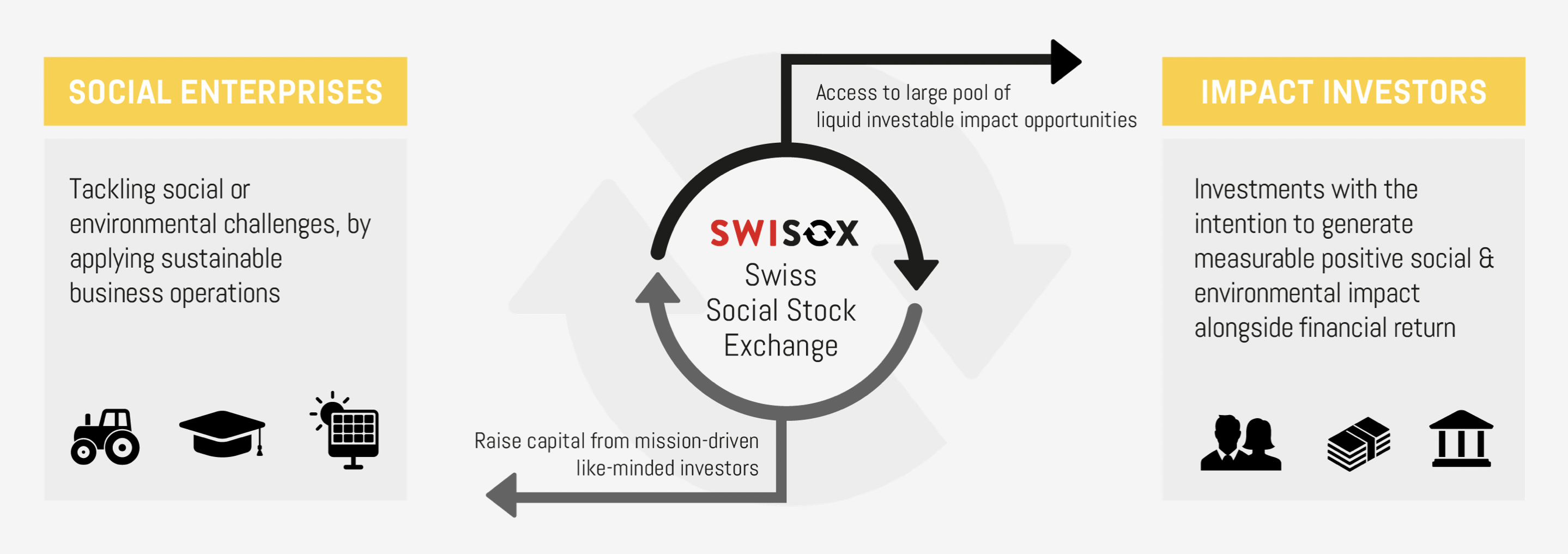

Social enterprises are becoming the new model responding to the societal challenges identified in the United Nations Sustainable Development Goals (SDGs). As the impact investing market grows at an average annual rate of 20%, several obstacles still prevent it from mainstreaming such as assessment of investment opportunities, size of transactions, viable exit options and measuring impact. The global growth of SMEs, their significant lack of access to finance, combined with a strong and growing trend of impact investing is an opportunity for the SWISOX project.

SWISOX will bring innovations such as specialized social indices and new social finance analysis tools.

Geneva as a benchmark for impact investment

Geneva is singularly positioned to develop an international stock exchange specially dedicated to social enterprises. With a long humanitarian tradition recognized internationally, Geneva remains associated, in the minds of many people living abroad, as a city committed to humanitarian action. At the same time, Geneva has a stronghold in the global world of finance, as it remains one of the top financial centres in the world and an essential bastion of private wealth management. Thanks to the unique ecosystem that brings together international organizations, leading banks, the Lake Geneva region has been at the centre of many innovations in sustainable finance in recent years and remains a world benchmark in terms of impact investing.

Lessons for success

SWISOX is building on the pioneering efforts of earlier attempts to create social financing exchanges-cum-platforms. SWISOX has distilled valuable lessons learned that will underpin its success.

Four key success factors

1. Located in Switzerland, a unique ecosystem combining the world’s largest center of wealth management with the epicenter of the UN SDGs

2. Created as sub-segment within an existing regulated stock exchange, leveraging the infrastructure

3. A quantitative and standardized social impact scoring system to determine eligibility

4. AI-powered feeder structure to identify the most promising issuers.

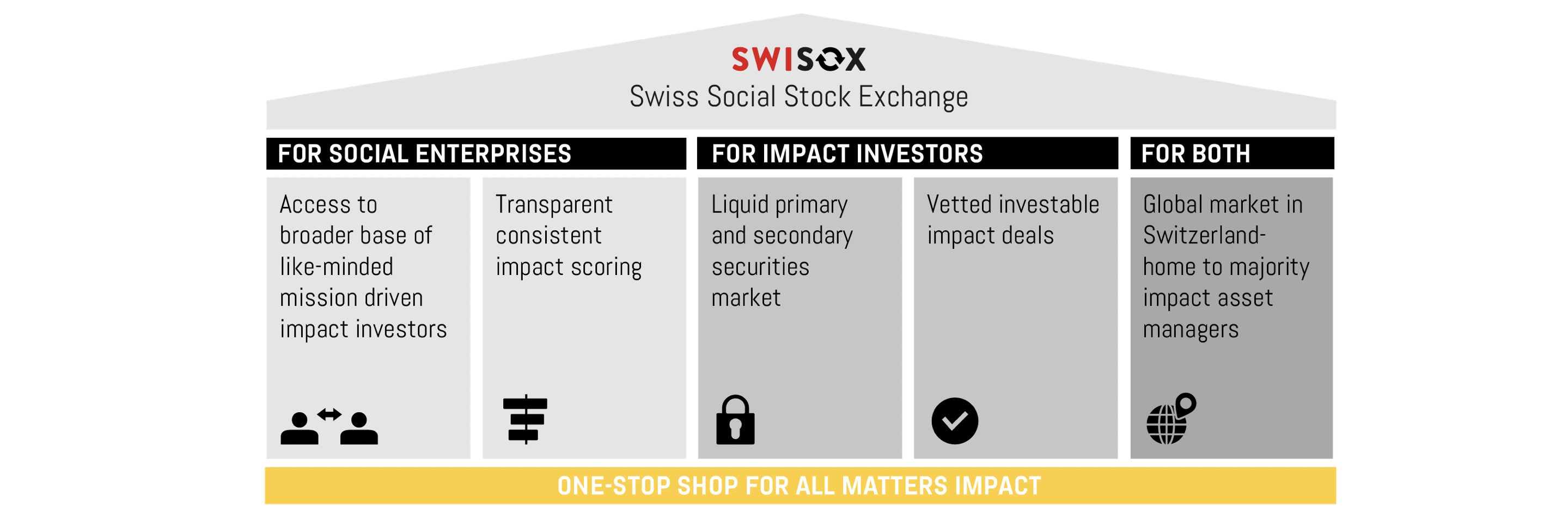

Value Proposition

Matching impact investors with the vetted and investable impact deals presents a significant opportunity for SWISOX to become a “one-stop-shop” for all.